- November 6, 2025

- Posted by: Educational V.

- Categories: Grants, Save Money, Scholarships

For most students and families, the college funding conversation starts and ends with the FAFSA, student loans, and scholarships offered by expensive private universities that really just serve as tuition discounts to attract students. But what if I told you there are hidden funding sources to pay for college that students don’t know about? This isn’t money reserved for valedictorians or Olympic athletes. This is money awarded to students who are willing to do a bit of work to seek it out – no matter their GPA, their background, their financial status, or their special skills. Because there is money out there for anyone interested in going to college.

So today, we’re putting on our detective hats and going beyond the obvious. Here are five powerful, little-known sources of funds that can significantly reduce your college bill, giving you the playbook to make college affordable.

The Ultra-Specific Scholarship World (And the Tools to Find It)

Win more scholarships with less effort

Simplify and focus your application process with the one-stop platform for vetted scholarships.

Forget the scholarships for straight-A students or star athletes—those are highly competitive. The real treasure is in the hyper-specific, low-applicant-volume scholarships that most people don’t qualify for or don’t even know exist – these kinds of scholarships are one of the hidden funding sources to pay for college.

Your Hobby, Your Money

Scholarships exist for almost every unique interest imaginable. Are you a left-handed student? Do you have an interest in bee-keeping? Have you ever thought of submitting a design for a greeting card? There are awards for all of these! The small size of the applicant pool dramatically increases your odds of winning.

Unique Family Ties

Look into your or your parents’ union memberships, professional associations, or military service (beyond the GI Bill). Organizations like the American Welding Society or local credit unions often offer exclusive scholarships to members and their families.

The “Weird” Essay Contest

You can find scholarships that award money for writing a short essay on subjects like the zombie apocalypse or what your superpower would be. They are often less work than you think and, again, face less competition.

Access the ScholarshipOwl Platform to Conquer the Specialized Search

Stop Googling for scholarships, which could literally be a full-time job. And why spend all that time when ScholarshipOwl can do all of that searching for you??

Instead of receiving endless pages of search results that require you to click and click and click just to see if you are a match, with ScholarshipOwl, all you’ll need to do is create your profile. The platform’s AI-powered smart system then sifts through its database of thousands of scholarships and gives you a curated match list that aligns with your profile.

This centralized approach helps you to find scholarships that help comprise the hidden funding sources to pay for college:

- Find Hidden Matches: It unearths those ultra-specific scholarships you would never have thought to search for.

- Save Time: You can often apply to multiple matched scholarships using the same core profile information, dramatically increasing the number of applications you can submit.

- Make Sure You Never Miss a Deadline: The platform helps you track your applications and deadlines in one place.

Not yet a member of ScholarshipOwl? Just go to www.ScholarshipOwl.com and start a free 7-day trial to try it out for yourself!

Local Scholarships in Your Community

School counselors always recommend that students focus on local scholarships. Why? Because when you apply for local scholarships, you’re competing against a smaller pool of applicants. This is because local scholarships are offered by local organizations and businesses that want to award their funds to students in their local community. Since only local applicants are eligible, you’ll have a better chance of winning!

The challenge with local scholarships is knowing how to find them – and that is why they are part of the hidden funding sources to pay for college. Most small businesses and nonprofit organizations don’t have the resources to promote their scholarships, so the funds are often available, but they don’t attract applicants simply because students don’t know the scholarships are being offered. So how can you find these local scholarships? You’ll need to do a bit of detective work of your own!

Ask Your School Counselor or Financial Aid Officer

Your school counselor. college-advising office or college financial aid office will maintain a dedicated, non-public list of scholarships that are available to their students. Ask for this list, and also inquire about any specific scholarships that your counselor or financial aid officer feels you are particularly qualified for.

Local Businesses & Foundations

Your town’s Rotary Club, Kiwanis, Elks Lodge, or community foundation gives out money every year. The applications usually require a short essay or a local reference, but the applicant pool can be tiny—sometimes only a handful of students apply! So checkout their websites or call these organizations to ask about their scholarship opportunities.

Past Participation Pays

Don’t forget about organizations you were a member of or volunteered for in the past, such as local sports leagues, 4-H clubs, volunteer centers, scout troops, school clubs, and more. These groups often have dedicated scholarship funds for former participants that receive very few applications simply because no one knows about them!

So think back and write down ALL of these kinds of organizations that you have been involved with, and then reach out to each one to ask if they offer scholarships.

Places of Worship

Contact your place of worship. Many religious organizations have dedicated educational funds for their youth and members who are pursuing higher education.

College-Specific Departmental Awards

When you think of university scholarships, you probably think of the big ones from the Admissions Office. However, another large pool of money comes from individual departments, so these kinds of scholarships are another example of hidden funding sources to pay for college.

Academic Department Awards

Once you have been accepted to a university and know that you plan to attend that institution, reach out to your major department (e.g., the Chemistry Department, the History Department, the School of Music, etc.) These departments often have their own grants and scholarships specifically for students pursuing that field of study. Since the applicant pool is limited to students in your major, your chances are much higher of receiving these scholarships.

Upperclassman Scholarships

Don’t forget to apply for scholarships throughout your entire time in college. Many students only look for university scholarships when they are an incoming college freshman. But significant scholarships are often reserved for sophomores, juniors, and seniors to reward them for maintaining their grades in a specific major, and to keep costs down for students continuing in their degree program. So keep applying for scholarships throughout your entire college career!

Income-Eligible Students Can Receive Free Tuition at Many Institutions

Did you know that there are many colleges that openly participate in programs that enable you to access reduced tuition or even FREE tuition?? It’s true!! These programs often fly under the radar because students don’t know they even exist, so how would they know which colleges offer them??

Colleges that Offer Free Tuition to Qualifying Students Based on Household Income

Private Colleges and Universities

Many top colleges offer free tuition for students based on household income – here is a partial list:

- Brandeis: Free tuition for students with a household income under $75,000 per year

- Brown University: Free tuition for students with a household income of $125,000 or less

- Carnegie Mellon: Free tuition for students with a household income under $75,000 per year

- Columbia University: Free tuition for students with a household income of $150,000 or less

- Cornell University: Free tuition for students with a household income under $75,000 per year

- Dartmouth University: Free tuition for students with a household income of $125,000 or less

- Duke University: Free tuition to North Carolina and South Carolina students with a household income of $150,000 or less per year

- Harvard College: Free tuition, room and board for students with a household income of $100,000 or less; free tuition for students with a household income of $200,000 or less

- Massachusetts Institute of Technology (MIT): Free tuition for students with a household income under $200,000 per year

- New York University (NYU): Free tuition for students with a household income of less than $100,000

- Princeton University: Free tuition for students with a household income under $160,000 per year

- Stanford: Free tuition for students with a household income under $150,000 per year

- University of Pennsylvania: Free tuition for students with a household income under $200,000 per year

- Yale University: Free tuition for students with a household income under $75,000 per year

Public Four-Year Colleges and Universities

Many states offer free tuition to in-state public universities for residents based on income. Here is a partial list:

- California State University (CSU): In general, in-state residents who qualify for federal or state grant aid won’t have to pay tuition at a CSU campus if their household income is less than $70,000

- New Jersey: Several public universities in New Jersey offer free tuition to in-state residents with a household income of $65,000 or less

- New Mexico – All Public Colleges: All in-state residents of New Mexico are offered free tuition at any public college in the state

- State University of New York (SUNY): In-state residents offered free tuition if they have a household income of $125,000 or less

- University of California (UC): In-state residents offered free tuition at all UC campuses if they have a household income of $80,000 or less

- University of Illinois: In-state residents with a household income and assets of $75,000 or less receive free tuition

- University of Michigan – Ann Arbor: High-achieving, in-state residents with a family income and assets below $125,000 are eligible for free tuition

- University of North Carolina-Chapel Hill: Students from families at or below 200% of the federal poverty guideline may be eligible to graduate debt-free

- University of Texas: All 9 UT colleges have waived tuition for students with a household income of $100,000 or less per year

- University of Wisconsin: In-state residents earning $55,000 or less per year are offered free tuition

Public Community Colleges

All community colleges are low-cost, and are a great option for students! You can earn an associate degree or certificate at a community college and then look for immediate employment in your field, or you can transfer to a university to complete your bachelor’s degree.

But in addition to being generally l0w-cost, did you know that 35 states offer free tuition to in-state residents who attend a community college?? It’s true! So we’ve got another example of hidden funding sources to pay for college! Some of these programs do have specific eligibility requirements, so be sure to check out the details as you investigate the community colleges in your state.

The following states have free tuition to in-state residents who meet their eligibility requirements:

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Georgia

- Hawaii

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Missouri

- Montana

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- Oklahoma

- Oregon

- Rhode Island

- South Carolina

- Tennessee

- Vermont

- Virginia

- Washington

- West Virginia

- Wyoming

Private Colleges that Enable You to Work in Exchange for Tuition

There are a handful of unique colleges that offer a no-tuition model. Students work an on-campus job (in the library, dining hall, or farm) in exchange for free or significantly reduced tuition. Checkout this list of colleges:

- Alice Lloyd College – Kentucky: Students who live in the Central Appalachia can work on campus or in the community for 160 hours per semester in exchange for tuition

- Barclay College – Kentucky: Christian college that awards free tuition to all students

- College of the Ozarks – Missouri: Students work in various roles to cover the cost of their education at this Christian institution

- Curtis Institute of Music – Pennsylvania: All admitted students receive free tuition

- Deep Springs College – California: Small, men’s only college where students work in exchange for free tuition as well as free room and board

- Haskell Indian Nations University – Kansas: Tribal university that offers free tuition to Native Americans and Alaska Native students from federally recognized tribes

- Warren Wilson College – North Carolina: All North Carolina residents who qualify for federal or state need-based aid are offered free tuition

- Webb Institute – New York: Naval architecture and marine engineering college that offers free tuition to all students

- Williamson College of the Trades – Pennsylvania: Men’s only college that offers free tuition and free room and board to all students; education is focused on the trades

- Join the Armed Forces to access education benefits through the GI Bill

Access Reduced Tuition at Public Institutions Outside Your Home State

Did you know that you can often attend an out-of-state public university without paying the full cost of non-resident tuition?? You can!!

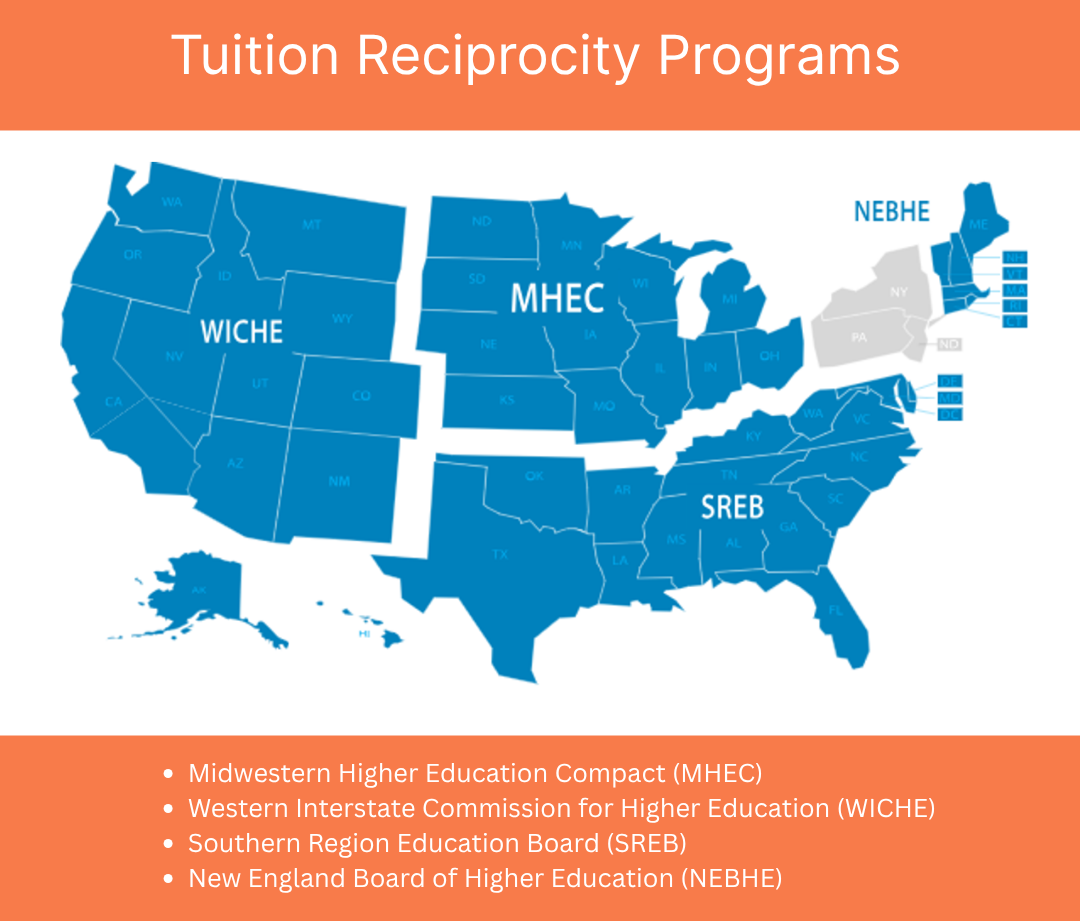

Many public universities participate in a tuition reciprocity program with nearby states. This means that if you live in one state but would like to go to college in a state near the one you live in, you may be able to do so at a cost that is less than their typical sticker price for non-residents.

Here’s How Tuition Reciprocity Works

- A tuition reciprocity program is one in which public universities offer a reduction in their out of state tuition costs to residents of nearby states. This helps to enable students to have greater equity, access and opportunity to receive higher education outside of their home state.

- Not all universities participate, and there are sometimes parameters that need to be followed – for example, sometimes students must meet minimum GPA or test score requirements to be offered the tuition reduction, or in some instances, colleges might offer a tuition reduction only for certain majors.

Does Your State Participate?

Participating states include:

- The Midwestern Higher Education Compact, or MHEC, offers the Midwest Student Exchange Program. This program serves public universities located in Illinois, Indiana, Kansas, Michigan, Minnesota, Missouri, North Dakota, and Wisconsin. If you live in one of those states, you may be able to qualify for a reduced tuition rate at one of the public universities in one of the OTHER states in the list.

- If you live in the Western Interstate Commission for Higher Education region, or WICHE, then your state participates in the Western Undergraduate Exchange program, or WUE. WICHE states and territories are Alaska, Arizona, California, Colorado, Hawaii, Idaho, Montana, Nevada, New Mexico, North Dakota, Oregon, South Dakota, Utah, Washington, Wyoming and the U.S. Pacific Territories and Freely Associated States. If you live in one of these states or territories, you may be able to qualify for a reduced tuition rate at one of the public universities in one of the other WICHE states.

- The Southern Regional Education Board Academic Common Market serves Alabama, Arkansas, Delaware, Florida, Georgia, Kentucky, Louisiana, Maryland, Mississippi, North Carolina, Oklahoma, South Carolina, Tennessee, Texas, Virginia and West Virginia…Note though that Florida, North Carolina and Texas only participate at the graduate level.

- The New England Board of Higher Education’s “Tuition Break” program serves Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island and Vermont.

Note that there are some states that do not participate in a regional compact for undergraduate students. Those states are Iowa, New Jersey, New York, North Carolina, Ohio, Pennsylvania, and Texas. Note though that some of these states may offer other opportunities to qualify for a reduction in out of state tuition costs, so if you are interested in attending a school in one of these states, you should contact the school directly to ask about options.

Access Education Benefits Offered By Your Employer

If you are working, ask your human resources representative about education benefits available to employees. Numerous companies offer these kinds of benefits – but they might not take steps to promote them, so it’s your job to inquire and learn about all of the benefits you are eligible for! Examples of education benefits offered include:

- Tuition reimbursement

- Scholarships

- Free courses offered through education partners

To learn more AND access a list of major employers offering these kinds of benefits, checkout this blog!

Access Education Benefits Through Your Parent’s Employer

You might be surprised to learn that sometimes you can access special education benefits through your parent!

Tuition Exchange Program for Children of Parents Employed at a College

If your parent works at a college or university, they might be eligible for a Tuition Exchange Program. These programs allow their children of staff to attend their parent’s institution (or often one of hundreds of other participating institutions) tuition-free or at a significantly reduced cost. This is an incredible, albeit employment-based, hidden benefit!

Scholarships Offered to Children of Employees

Did you know that many employers offer scholarships to children of their employees? It’s something that is often little-known, because employees typically only learn details of available benefits when they are first hired. If your parent has been working for the same company for several years, they might have completely missed or overlooked these kinds of scholarships as you were younger when they got hired. So ask your parent(s) / guardian(s) to inquire at their place of employment to find out about scholarship opportunities for children of employees.

The Power of “Redirected Cash Flow”

This isn’t free money, but it’s found money—funds you already have that can be strategically redirected to college costs.

The “New” Budget

Once you’ve headed off to college, your parents’ expenses change. Money previously spent on things you needed while living at home can now be redirected into helping to pay college costs.

Examples:

- If you don’t need a car while in college, your parents can remove you from their auto insurance policy. If your family had previously helped pay for your gas, they will no longer have those costs.

- If you are no longer living at home, your family’s food and utility costs will be lower.

- Fees previously paid for your participation in sports and other activities will no longer need to be paid.

Saving even $400 a month adds up to nearly $5,000 a year. If your family is able, those savings can be re-directed towards your education.

College Payment Plans

Many universities offer interest-free, monthly payment plans for tuition and/or housing. Instead of paying a massive lump sum, you can use your “redirected cash flow” to pay your bill over time. While this isn’t “found money,” you’ll find it’s easier to pay a large bill over time vs. all at once.

Your Hidden Money Awaits: Now It’s Time to Claim It

Don’t let the sticker price intimidate you, because there are so many hidden funding sources to pay for college! The money is out there—it’s just waiting for the determined student willing to do the detective work. Every $500 award you win is $500 less you have to borrow! For more tips and access to the leading scholarship platform, visit www.scholarshipowl.com!